MONUMENT OPPORTUNITY FUND

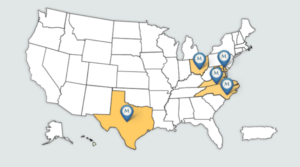

Monument Opportunity Fund (MOF) is the second fund launched by Monument Capital Management. MOF purchased 15 properties in 15 months for a total of more than $152 million. Building on the success of Monument Multifamily Investors Fund, MOF utilized a similar investment strategy identifying and acquiring workforce housing in key locations. For this fund, Monument Capital Management expanded its target area from the Mid-Atlantic and Southeast to also include the Midwest and Southwest regions of the U.S. in order to diversify the portfolio and capitalize on opportunities in the multifamily market.

-

Maryland

Oaks At Park South [510 Units], Oxon Hill, MD Purchased For $36,936,225 Monument Opportunity

-

Virginia

Frontier Apartments [182 Units], Roanoke VA Purchased For $8,650,000 Monument Opportunity

-

North Carolina

Somerset [240 Units], Charlotte, NC Purchased for $4.94MM, $850K Rehab Monument Opportunity

-

Ohio

Universal Development Portfolio [682 Units], Columbus, OH Purchased For $30,000,000 Monument Opportunity

-

Texas

Madison Portfolio [481 Units], Pasadena, TX Purchased For $18,900,000 Monument Opportunity